However, when stacked up against other 0% APR business cards, it leaves a lot to be desired in rewards. There’s no annual fee, making it a cost-effective option for small business owners. It also includes benefits like free employee cards, fraud coverage, and year-end summaries, which can be valuable for managing business finances and monitoring expenses. The information provided in this article does not constitute accounting, legal or financial advice and is for general informational purposes only.

Make Sure the Balances Are Accurate

By catching these differences through reconciliation in accounting, you can resolve discrepancies, help prevent fraud, better ensure the accuracy of financial records, and avoid regulatory compliance issues. It not only allows you to protect your clients’ funds, but your firm too as a result. The cash account is reconciled to bank meaning of purchase in accounting statements rather than a subsidiary journal (sub-ledger) for that account. Accounting software and ERP systems have built-in features and electronic forms to reconcile cash accounts with bank statements. For example, reconciling general ledger accounts can help maintain accuracy and would be considered account reconciliation.

Fixed assets and accumulated depreciation

Businesses are generally advised to reconcile their accounts at least monthly, but they can do so as often as they wish. Businesses that follow a risk-based approach to reconciliation will reconcile certain accounts more frequently than https://www.kelleysbookkeeping.com/ others, based on their greater likelihood of error. Not producing a reconciliation report when one is needed will also make it more time consuming to produce future reconciliations, due to it being harder to unpick the differences.

- The Ramp Card is an innovative corporate card, particularly suited for LLCs, that combines automated expense management features with 1.5% cashback rewards on purchases.

- These reconciliations can be performed in several ways, depending on the context.

- Careful attention to details and review of reconciliations by someone who doesn’t work with that account can help catch many instances of fraud.

- Chase’s Ink Business Unlimited Credit Card is a no-frills 0% APR credit card.

- By catching these differences through reconciliation in accounting, you can resolve discrepancies, help prevent fraud, better ensure the accuracy of financial records, and avoid regulatory compliance issues.

What Is Month-End Reconciliation?

Make any required adjustments between the categories based on a calculation of short-term notes payable liabilities for the next 12 months to classify amounts in the categories as short-term or long-term correctly. And while most financial institutions do not hold you responsible for fraudulent activity on your account, you may never know about that fraudulent activity if you don’t reconcile those accounts. Keeping your accounts reconciled is the best way to make sure that your balances are accurate and an important part of ensuring adequate financial controls are in place. Accounting reconciliation plays a fundamental role in ensuring that financial statements are reliable, detecting errors, preventing fraud and maintaining compliance with regulatory requirements. Businesses that prioritise effective reconciliation practices put themselves in a strong position to make informed decisions, mitigate risks and maintain the financial health necessary for long-term success. For a small business or an account with very few transactions, reconciliation may not be a challenge.

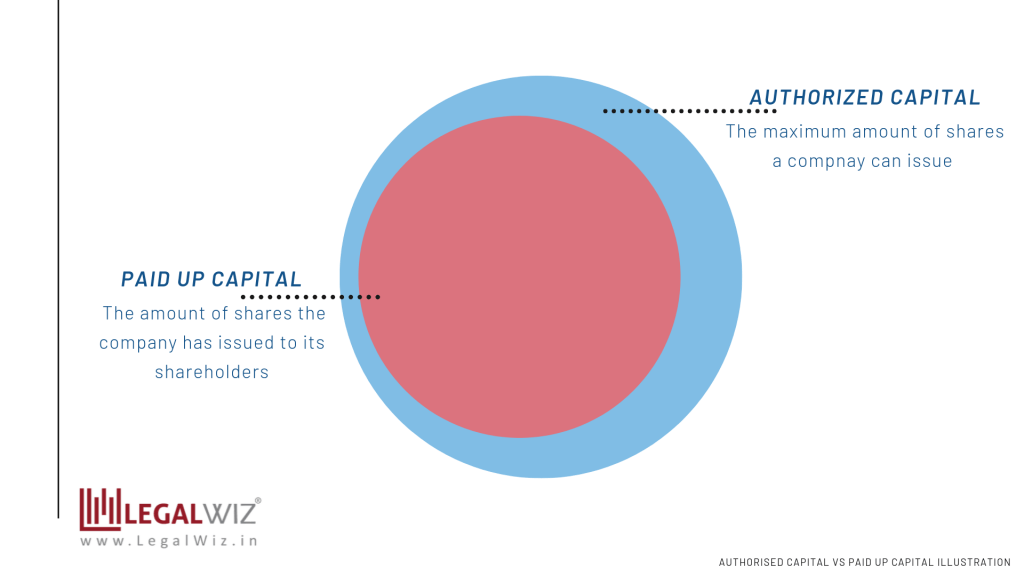

To learn more about how Clio can help law firms to easily manage trust accounting and three-way reconciliation, while staying compliant, read our guide here. Capital accounts activity includes par value of the common stock, paid-in capital, and treasury share transactions. Using a schedule of general ledger accounts, analyze capital accounts by transaction for any additions or subtractions.

Whether you have high transaction volumes or complex transaction scenarios, Stripe’s reconciliation solution offers scalable and reliable support for your financial operations. Account reconciliation is the process of cross-checking a company’s financial records with external documents, such as bank statements. Its purpose is to ensure accuracy and consistency of financial data, which is vital for informed decision-making and maintaining financial integrity. Account reconciliation is particularly useful for explaining any differences between two financial records or account balances.

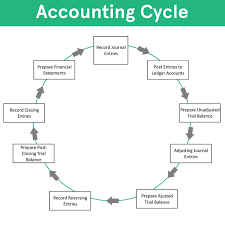

It then makes sure that the purchase got logged correctly on both the balance sheet and income statement. So, the business records the purchase as a credit in the cash account and a debit to the asset account for reconciliation. Account reconciliation is done to ensure that account balances are correct at the end of an accounting period. The account reconciliation process also helps to identify any outstanding items that need to be taken into consideration in the reconciliation process.

And if you never reconcile your accounts, chances are that fraudulent activity will continue. Sometimes a deposit or a payment recorded in your accounting software isn’t on the monthly bank statement. When paper checks were the main way that vendors and employees were paid, this was a much bigger problem.

The American Express Blue Cash Preferred® Card is meant for businesses that spend significantly on groceries and gas. It offers a cash-back rewards rate of 6% at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%) and 3% cash back at U.S. gas stations. It also includes 3% cash back on transit, including taxis/rideshare, parking, trains, and buses.

During the reconciliation process, corrections may be made to the general ledger with adjusting journal entries. Or correct the sub-ledger if an error like the duplicate recording of a transaction is a reconciling item. The steps in balance sheet account reconciliation vary by type of account but may be generalized to include the following numbered https://www.accountingcoaching.online/cash-flow-vs-free-cash-flow/ steps. Reconcile general ledger accounts to balances of short-term investments with a maturity period of 90 days or less, using brokerage and investment firm statements or financial institutions statements. Cash equivalents include treasury bills, commercial paper, money market accounts, marketable securities, and short-term government bonds.

If there are any differences between the accounts and the amounts, these differences need to be explained. Reconciling your bank statements allows you to identify problems before they get out of hand. The analytics review approach can also reveal fraudulent activity or balance sheet errors. In this case, businesses estimate the amount that should be in the accounts based on previous account activity levels. These different types of reconciliation are important for maintaining accurate financial records, detecting errors and fraud, and ensuring the reliability of the accounting system. They give organisations a clear and accurate picture of their financial position, which enables them to make informed business decisions.